Rewire, Don’t Retire: Changing the Narrative on Retirement

August 23, 2023 by Kelly Arenz

Picture this – you’re thinking of retiring. You’ve reached the magical age of 65. It is now time to retire from the hustle and bustle of the last 30+ years of work, and transition from being a lifelong contributor to the labour force, to a life of freedom, choice, and perhaps sporadic income payments.

Financially, you’ve been preparing for this day for what seems like a lifetime – pension contributions, financial planning conversations, retirement cashflow models, calculations, to assure you that switching off your regular income will be fine and that you will live out the rest of your days on a sustainable plan. We can all agree that retiring in the traditional sense takes considered financial planning, which many of us think about and prepare for during our whole working careers.

So, with a solid financial plan in place you can now start considering all the pros of retiring. And there are many – the opportunity to finally relax, enjoy the simple things in life, travel, spend more time with loved ones, and pursue things you’ve always been wanting to do but never had the time to. Sounds great, doesn’t it? So why is it then that multiple studies have shown that one in four people suffer depression after entering retirement?

Emotionally, the transition into retirement has been found to be one of the biggest challenges in our lives. As the ‘honeymoon’ stage of this phase of life wears off, disenchantment creeps in for many. It ranks up there with the top causes of stress such as divorce, bereavement and moving house. When researchers examined the underlying causes of this, they found that it wasn’t retirement per se but rather the lack of preparedness for this major transition. While change is inevitable, it seems that without the emotional preparation new retirees struggle to find their way in this unfamiliar territory. It makes sense though; work is an important part of one’s life and identity for so many years. Work provides purpose, mental stimulation and fills our days with routine and structure. So once that falls away, and all at once, feelings of depression and loss can often creep in.

Professor Richard Oxtoby, Professor emeritus of Psychology at UCT puts it bluntly, ‘There is research to the effect that remaining mentally active prevents decline and delays the onset of the symptoms of ageing. Many of the characteristics that we see in old people are not as a result of ageing, but of individuals having relinquished their vibrant hold on life.” Given what is known in neuroscience, this mental decline should not be inevitable in retirement, for the brain retains its plasticity into old age. “With retirement then you can – no must – if you want to keep the dendritic trees blooming in your brain – substitute new types of mental activity for the old,” writes another expert on the subject, Robertson.

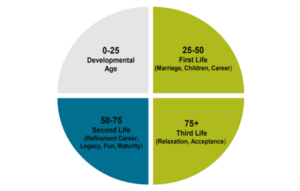

So why is it then that society continues to portray retirement as one long carefree walk along a sunlit beach when all signs point to the fact that retirement should not be approached like this? Preparation for retirement, therefore, is crucial. And it is not only being financially prepared – that is only half of the puzzle. The other half, when looking to retire, is making personal (non-financial) decisions as to how you will continue to be fulfilled in your daily life for the rest of your life. Due to increased longevity across our population, retirement spans nearly the same number of years as one’s working career. Essentially, it is a whole extra season of life (see chart below). Surely then, it takes as much premeditated and conscious thought as to how this season of life will look and evolve.

Source: Presentation by Lynda Smith – certified retirement coach and founder of refirement network/50plus skills.[1]

Perhaps we don’t consider this because too often we think about life in black and white terms, forgetting the rich space of grey matter in between. Life in black and white terms is the current three-stage life of education, career and retirement. However, the rich grey space sees this three-stage life replaced by a multistage life with new stages, new ages and with the potential for much greater individualised design. Individualised design is where the important concept of Rewirement comes into play. Rewirement looks to challenge and change the traditional sense of retirement with all its connotations of withdrawal and re-package it into something far more positive. ‘North of 52’ [2] defines the two words as follows:

- ‘Retirement: comes from the root word Retire. To withdraw, move back, retreat, cease to work or contribute.’ This stage is often entered into at the ‘magic’ age of 65 or at state pension age.

- ‘Rewirement: comes from the word Rewire. To add new wires and pathways, rebuild, learning something new.’ This stage can be entered into at any age you prefer.

How to rewire and lead a multistage life is therefore the question… I like to think the answer is perfectly explained by a concept named the Portfolio Life. Break the Twitch[3] defines a portfolio life as follows: ‘Living a Portfolio Life means you have multiple interests and can apply them in a variety of fields and contexts.’ The concept of a Portfolio Life recognizes that our lives are a myriad of many things that provide fulfilment. It encourages you to embrace the Venn diagram of your life and gives you permission to define your life beyond just your paid work, breaking down the black and white barriers that limit us (i.e. the outdated concept that we need to follow a three-stage life). Reaching Rewirement stage is a perfect time to explore the concept of a Portfolio Life. In a way, however, I’d argue this concept should be continuously explored throughout life. Readapting your circuitry to be who you want and do what you want, and living a Portfolio Life, is a concept far more in tune with an exciting stage lasting multiple decades where your brain retains plasticity, you are fulfilled and your state of wellbeing increases.

My favourite description of Rewirement is quoted as follows: ‘Rewirement is a lifestyle, an attitude that consciously treats life as a journey, not an event. Rewirement challenges us to look at our lives with intent and explore ways to learn new skills, challenge our minds, gain new experiences, strengthen our bodies, and enhance our relationships. Rewirement (not retirement) literally rewires our brains and forms new pathways. It’s not a one-shot, time-based deal. It’s a continual, exciting experience that enables us to live a positive, fulfilling life not bound by time or societal boundaries (like mid-life and retirement)’. How you decide to define Rewirement for yourself is completely individualised and can take on many different forms.

Therefore, I would encourage you, in your preparations for Rewirement, to remember not only to have a financial plan in place, but a life plan for your transition into a multistage life. Have a road map to what you’d really like from these exciting next stages of life and be as intentional about it as you were your career. And always remember that life planning and financial planning go hand in hand in making this big transition a success!

[1] https://tafta.org.za/dont-retire-refire/

[2] https://northof52.com/blog/rewirement-not-retirement

[3] https://www.breakthetwitch.com/portfolio-life/

Additional References:

- https://www.goodwinrecruiting.com/its-not-retiring-its-re-wiring-come-unretire-with-me

- https://www.irishlife.ie/blog/is-retirement-bad-for-you/